Follow Us

April 12, 2024

Here's the list of the nominees for the Small Business Awards as of April 12. Nominations will remain open until May 3.

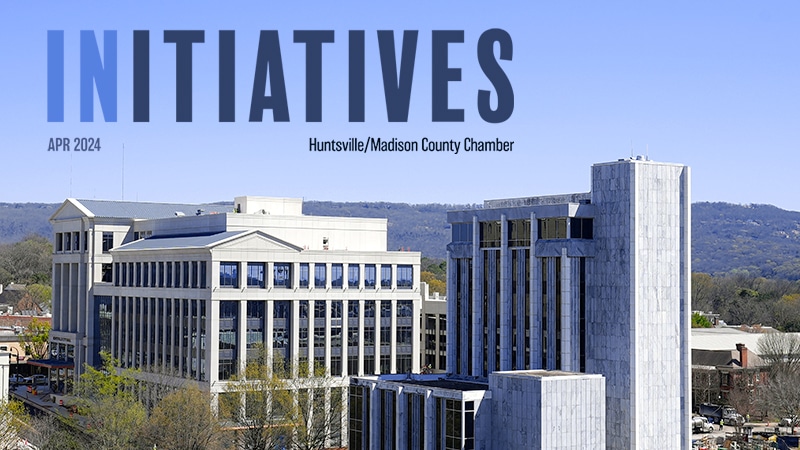

April 4, 2024

Read along as we spotlight recent developments in downtown Huntsville in our cover story. We also profile local small businesses and wrap up our recent Montgomery Trip.

April 4, 2024

Carey Miller shares how she and her family landed in Huntsville and how Deloitte is making an impact in the business community.

April 4, 2024

Congratulations to our Contenders for the 2024 Best Places to Work® Awards! These will be held on Tuesday, May 14 at 11:30 a.m. in the Von Braun Center Saturn Ballroom. We look forward to celebrating with you.

RECENT EVENTS

All images taken by the Huntsville/Madison County Chamber are available for our members to use.